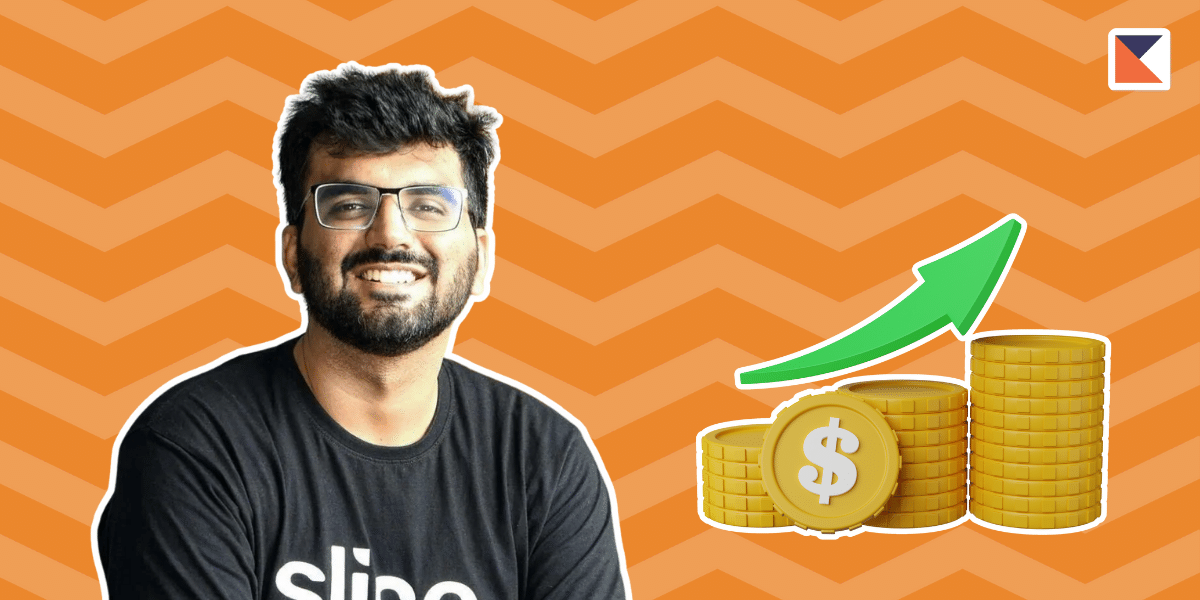

Slice, a popular consumer lending and payments startup, has secured a significant boost in funding. They’ve bagged $9 million from Stride Ventures in debt funding, marking their first financial backing in 2023.

In a recent regulatory filing with the Registrar of Companies, Slice unveiled their move to issue 7,500 non-convertible debentures, each valued at Rs 1,00,000, raising a total of Rs 75 crore or $9 million. These debentures, with a fixed interest rate of 14.25% per annum, come with a tenure of 15 months.

But that’s not all. Another regulatory filing hints at the possibility of this debt round escalating to Rs 300 crore or $35 million, showcasing the potential for further financial strides.

Established in 2016 by Rajan Bajaj, Slice built a unique data-powered financial offering—the Slice Card. This card, available both physically and virtually, caters specifically to India’s young demographic, covering freelancers, college students, and employed professionals.

Apart from that slice also offers various other financial services through its mobile app.

This latest infusion adds to Slice’s existing funding of $340 million. Notably, the fintech unicorn soared in value to over $1.5 billion during its Series C round back in November 2021.